For business leaders, having a clear understanding of the size of a market is the cornerstone of developing a winning strategy. It helps pinpoint the biggest opportunities, assess their viability, and determine the best path for growth. But how do you accurately assess the size of your market? And how can that understanding empower informed decisions to drive business success?

The three key metrics used in market size analysis are: Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM). Let’s explore how each metric contributes to a more nuanced perspective on your market potential and refines your strategic approach.

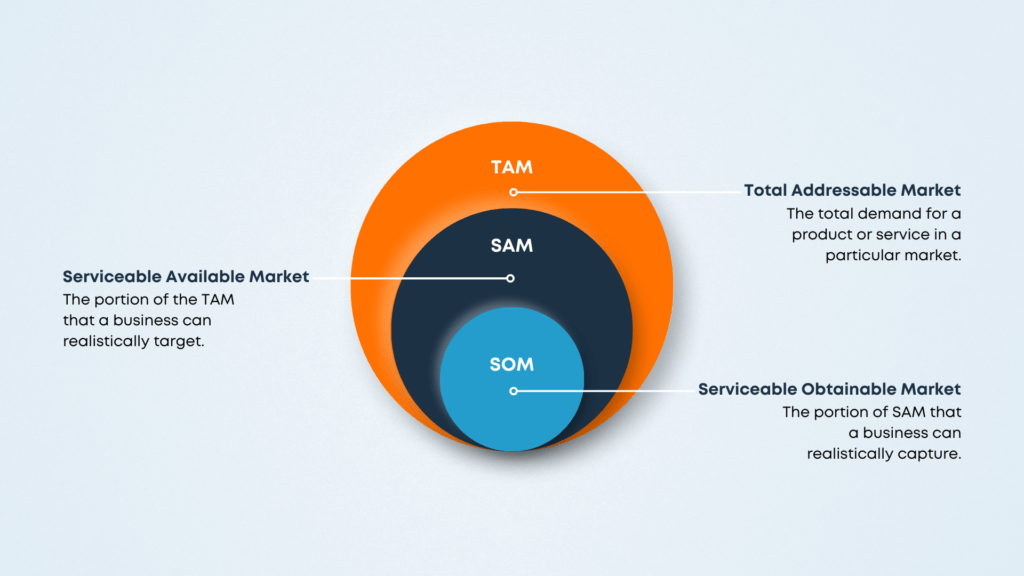

Total Addressable Market, or TAM, represents the total demand for a product or service in a particular market, assuming there are no competitors or barriers to adoption. It’s the maximum amount of revenue a business can generate if its product or service achieved 100% market share.

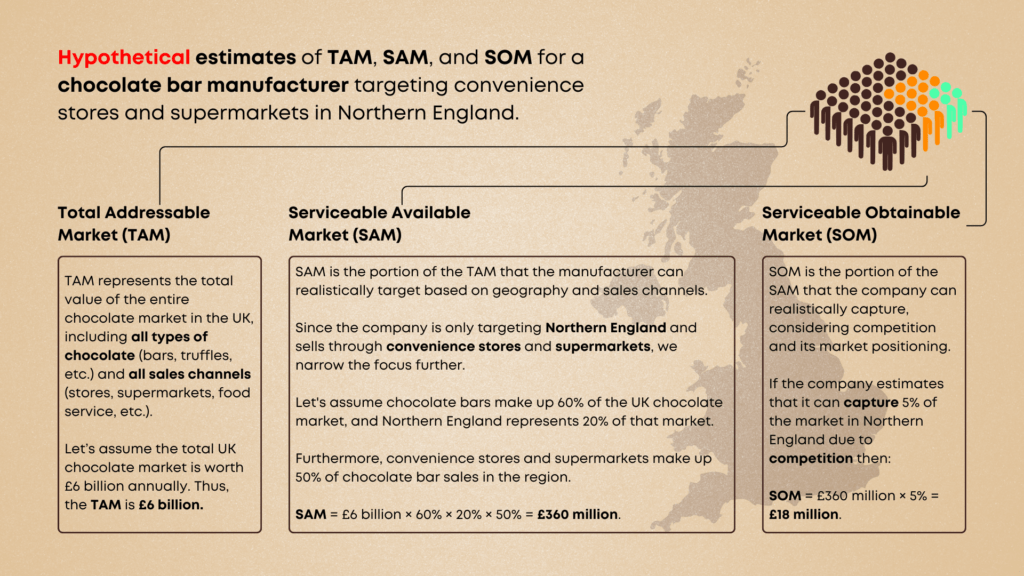

For example, let’s assume that a company produces chocolate bars in the United Kingdom. The TAM would include the total value of the UK chocolate market, comprising not just chocolate bars but all types of chocolate, such as confectionery and specialty products.

In this scenario, TAM assumes that the company could, in theory, address the entire UK chocolate market, which provides a top-level view of the market’s overall size.

Serviceable Available Market, or SAM, is the portion of the TAM that a business can realistically target based on factors like geographical coverage, product offerings, and sales channels. Unlike TAM, which represents the full potential market, SAM is more specific and focuses on the segment of the market that a business can actually serve.

Going back to the chocolate bar example, the SAM would include only the market for chocolate bars, excluding other types of chocolate. Furthermore, if the company sells exclusively in Northern England through convenience stores and supermarkets—while not targeting the food service industry—then the SAM would specifically focus on chocolate bar sales within that region and through those channels.

SAM, therefore, helps business leaders identify a more realistic revenue opportunity than TAM.

Serviceable Obtainable Market, or SOM, is the portion of SAM that a business can realistically capture, considering factors like competition, as well as its current capabilities and operational capacity.

For example, let’s go back to the chocolate bar manufacturer targeting convenience stores and supermarkets in Northern England. Estimating the SOM is based on the idea of “Fair Market Share,” which is essentially the portion of the market the company can reasonably expect to capture, taking into consideration its resources and the presence and influence of competing brands. In other words:

SOM = SAM x Fair Market Share

See the infographic below for a fictional example estimating TAM, SAM, and SOM.

As the example shows, TAM, SAM, and SOM help the company understand the full potential of the market, the portion it can realistically target, and the achievable market share based on its current position.

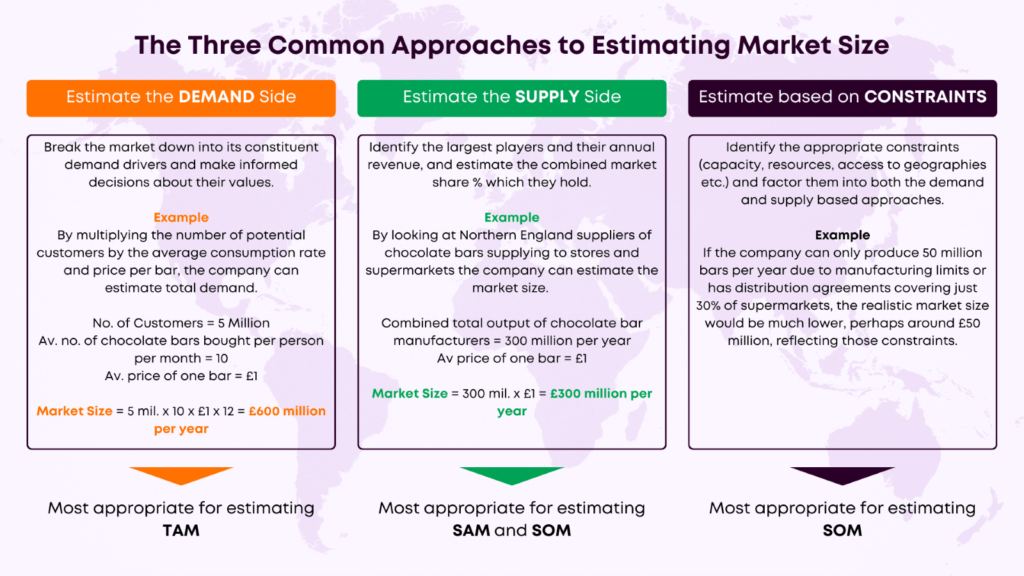

Market sizing can be approached in three main ways:

Demand-side approach: This estimates market size by analysing potential customer demand using “drivers” such as the number of customers, the frequency of purchase, the average number of products bought and the prices. This approach tends to estimate the “upper side of the market size” ie it tends to overestimate.

Supply-side approach: This looks at the overall market from the perspective of suppliers, evaluating the production capacity or sales data of competitors to gauge the market’s total size. Here by estimating the sales and/or capacity as well as their “market share” one can then derive the overall market size. This approach tends to estimate the “lower side of the market size” i.e. it tends to underestimate.

Constraints-based approach: This combines both demand and supply insights but factors in real-world limitations such as overall production capacity, distribution capabilities, or regulatory restrictions, providing a more grounded estimate of market size.

All of these approaches are valuable, and often the best results come from combining them. You’ll also want to factor in your own internal constraints, such as production capacity or distribution limits. Even with high demand, these constraints can cap your SOM.

Market sizing plays a crucial strategic role by enabling businesses to make data-driven decisions and identify key growth opportunities. Understanding the potential size of a market helps companies assess whether there is sufficient demand to justify investments in new products, services, or geographic expansions. By accurately breaking down the market into TAM, SAM, and SOM, companies can pinpoint the segments or regions that offer the most opportunity. This allows them to define strategic priorities focused on niches or geographic areas with the highest potential for growth where customer needs are under-served.

Another strategic benefit of market sizing is that it helps businesses understand the competitive landscape. By evaluating market size from both the demand and supply perspectives, companies gain insight into the competitive pressures they might face. This information allows them to position themselves strategically, focusing on segments where they can capture market share or developing unique value propositions that differentiate them from competitors.

Finally, market sizing plays a pivotal role in risk management and long-term planning. Accurately sized markets provide a solid foundation for sales and revenue forecasting, helping businesses set realistic targets. Furthermore, understanding market constraints, such as production limitations or regulatory barriers, enables companies to plan for risks and avoid overextending their resources. This not only improves operational efficiency but also prepares businesses for changing market conditions.

Market sizing isn’t just a technical exercise—it’s a strategic imperative for any business. By understanding your TAM, SAM, and SOM, you can gain valuable insights into your true growth potential. This knowledge allows you to allocate resources more effectively, target the right segments, and craft a winning strategy. Ultimately, market sizing equips you with the clarity and confidence needed to make informed decisions that drive long-term success.